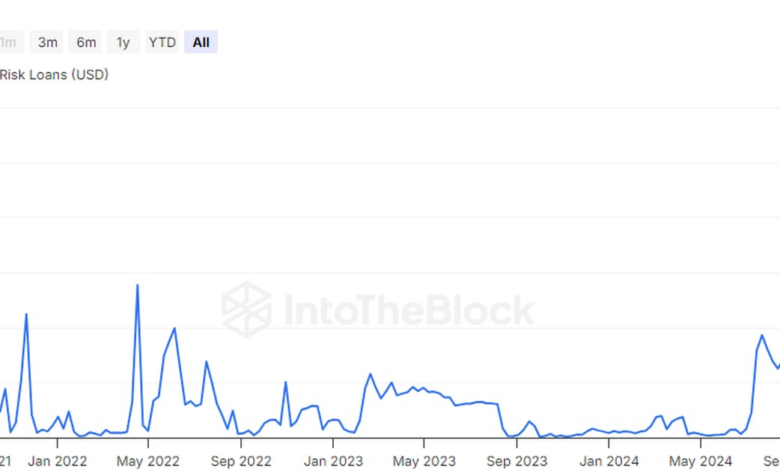

It is important to take note of the significant increase in risky loans in the cryptocurrency market, as this trend has the potential to trigger a cascade of liquidations. This self-reinforcing process involves a rapid succession of liquidations that ultimately results in a decline in crypto prices. Consequently, this downward trend leads to more liquidations and heightened market volatility.

As more investors turn to risky loans in the hopes of maximizing their returns, the likelihood of a liquidation cascade becomes more pronounced. The interconnected nature of the cryptocurrency market means that the repercussions of these liquidations can be felt across various assets and exchanges.

It is crucial for investors to exercise caution and carefully evaluate the risks involved in taking out these loans. While the lure of high returns may be tempting, the potential consequences of a liquidation cascade should not be underestimated. By staying informed and making informed decisions, investors can better navigate the complex and volatile cryptocurrency market.