The People’s Bank of China recently announced a significant move to stimulate the economy by cutting the reserve requirement ratio for mainland banks by 50 basis points. This decision was made in an effort to boost liquidity in the market and encourage lending.

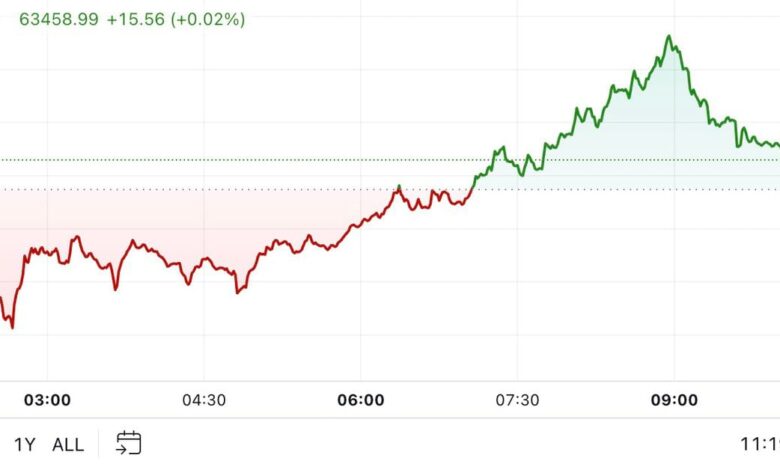

Surprisingly, the crypto market showed little response to this news. While traditional Asian stocks experienced a rally, with Hong Kong’s Hang Seng index climbing 3.2% and the Shanghai Composite index adding 2.3%, Bitcoin and other cryptocurrencies remained relatively stable.

According to Rick Maeda, a research analyst at Presto Research based in Singapore, the lack of reaction from Bitcoin highlights its current beta being more closely tied to Federal Reserve policy and U.S. markets. This is evident in the near two-year high correlations with U.S. stocks, particularly following last week’s FOMC meeting.

Overall, the People’s Bank of China’s decision to cut the reserve requirement ratio reflects ongoing efforts to support economic growth and stability in the region. While traditional markets responded positively, the crypto market’s muted reaction suggests a stronger correlation with U.S. economic indicators.