Unveiling the Market Dynamics: Binance’s SAFU Fund and LiquidChain’s Strategic Moves

Our editorial content is crafted with precision, reviewed meticulously by industry experts and seasoned editors. We adhere to transparent ad disclosures.

Essential Highlights:

- ➡️ Binance’s SAFU Fund has reportedly acquired approximately 3,600 BTC, valued at $233 million, showcasing a significant trust signal amid market turbulence.

- ➡️ Both Bitcoin (BTC) and Ethereum (ETH) are experiencing significant declines, with ETF drawdowns emphasizing a risk-averse, liquidity-tight market environment.

- ➡️ In risk-averse scenarios, markets often prioritize straightforward execution methodologies and robust settlement assurances over complex multi-chain processes.

- ➡️ LiquidChain aims to integrate BTC, ETH, and SOL liquidity into a unified Layer 3 execution environment, reducing fragmentation and operational risks.

Binance’s Strategic BTC Acquisition: A Beacon of Trust in Uncertain Times

In a market fraught with uncertainty, Binance’s emergency insurance fund has made a decisive move. On February 6, 2026, Binance’s SAFU Fund strategically acquired around 3,600 BTC, worth about $233 million, transferring it from a hot wallet to the SAFU address. This action brought the total SAFU Bitcoin holdings to approximately 6,230 BTC, reflecting an institutional-level commitment to market stability during volatile times.

The backdrop is challenging, with Bitcoin trading near $67,000—a sharp 9% drop as reported by CoinMarketCap. As BTC hovers nearly 50% below its October 2025 peak of $126,000, mainstream media is already hinting at a ‘crypto winter.’

The SAFU Fund is designed to address tail-risk events, such as hacks, insolvencies, and liquidity crises. By visibly bolstering its reserves during a downturn, Binance is sending a clear signal that trust is becoming a premium commodity in the market.

This movement towards safety is reigniting interest in infrastructure narratives. As liquidity becomes fragmented, traders are increasingly valuing simplicity and reliability. This shift presents a unique opportunity for LiquidChain (LIQUID).

SAFU’s BTC Acquisition and the Market’s Shift Towards Security

The timing of Binance’s acquisition coincides with a period of instability in ETF-driven positions. According to MarketWatch, Bitcoin-linked ETFs are experiencing significant drawdowns and outflows, highlighting the volatility of institutional investments. When technical support levels falter, the shift from ‘institutional buying’ to ‘institutional de-risking’ becomes evident.

This volatility affects not only the assets but also the routes of liquidity. Bridges, wrapped assets, and multi-hop swaps become riskier, leading to increased spreads and slippage. In such conditions, markets shift focus from maximizing returns to minimizing operational risks.

This environment elevates the importance of “single-step execution” and “verifiable settlement,” transforming them from buzzwords into essential requirements. Interoperability projects gain traction during downtrends, offering simplicity when the market is averse to complexity.

If the market declines further, risks remain high as new tokens often correlate with broader trends. However, if stabilization occurs, projects that minimize friction are likely to be prioritized again.

LiquidChain’s Vision: Unifying Fragmented Liquidity with a Layer 3 Approach

LiquidChain positions itself as “The Cross-Chain Liquidity Layer,” operating as a Layer 3 infrastructure protocol that consolidates Bitcoin, Ethereum, and Solana liquidity into one execution environment. The logic is simple: fragmented liquidity is not only inconvenient but also risky when bridge risks resurface.

The protocol offers a comprehensive feature set to address these challenges: Unified Liquidity Layer, Single-Step Execution, Verifiable Settlement, and a Deploy-Once Architecture. This approach aims to attract developers seeking distribution without redeploying on every chain and DeFi users looking for fewer transactions and reduced risks.

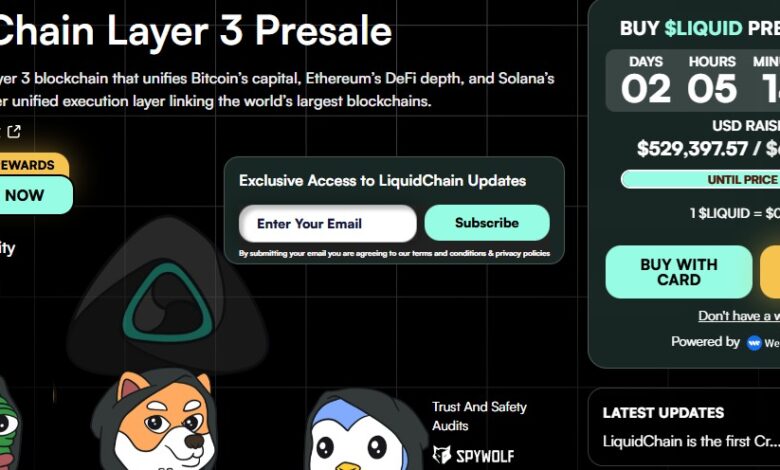

Presale figures indicate a positive market response. According to the official page, LiquidChain has raised $529,000, with tokens currently priced at $0.01355.

The key factor to watch is whether volatility continues to drive users toward execution environments that offer a “one-stop” solution. While interoperability is a competitive space, delivering robust settlement is more challenging than marketing suggests. Nonetheless, when exchanges are reinforcing insurance funds and ETFs are experiencing outflows, the demand for streamlined infrastructure remains strong.

For more information, visit the LiquidChain website or participate in the presale.

This article is for informational purposes only and should not be considered financial advice. Cryptocurrency investments carry risks, and presale investments can be particularly volatile.

Our Editorial Standards

At Bitcoinist, our editorial process is dedicated to providing well-researched, accurate, and unbiased content. We adhere to strict sourcing standards, with each article undergoing thorough review by top technology experts and seasoned editors. This rigorous process ensures the integrity, relevance, and value of our content for readers.