Insights into Bitcoin’s Future: A New Era of Global Competition

The Vision of a Bitcoin-Driven Global Arms Race

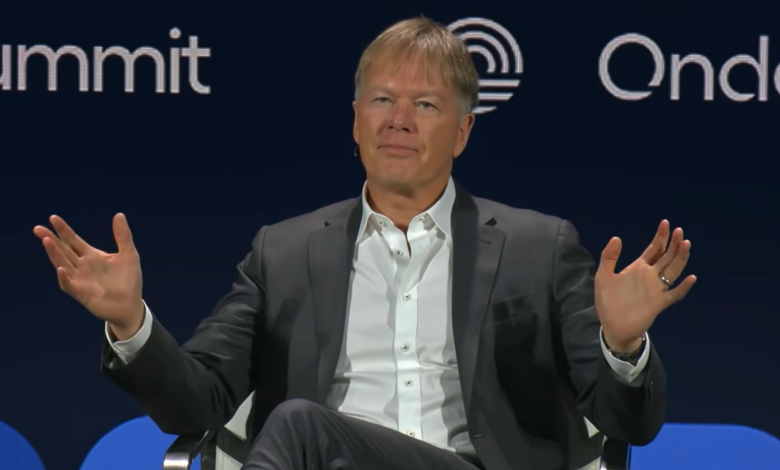

In a thought-provoking presentation at Ondo’s conference, Dan Morehead, CEO of Pantera Capital, shared a bold prediction that sovereign nations may soon compete fiercely for Bitcoin. He anticipates a significant surge in Bitcoin demand, driven by what he describes as a “global arms race” within the next few years. This shift, he suggests, arises as countries reconsider their reserve strategies amid evolving geopolitical dynamics.

Morehead envisions a scenario where nations like the United States, alongside allies such as the UAE, are already building strategic reserves of Bitcoin. He argues that countries historically opposed to the U.S., like China, will recognize the strategic risks of holding national savings in assets susceptible to U.S. influence. Instead, they may opt for Bitcoin, a decentralized asset immune to such pressures, as a safer alternative.

Potential Scale of the Bitcoin Arms Race

Morehead projects that within a few years, several global regions could engage in a competitive pursuit to acquire substantial Bitcoin reserves, possibly targeting millions of bitcoins each. He advises investors to position themselves advantageously before this potential arms race escalates.

Dan Morehead’s Optimistic Stance on Bitcoin’s Long-Term Potential

In addition to his forecast of a Bitcoin arms race, Morehead offered insights into Bitcoin’s market dynamics. Despite recent market fluctuations, he sees these as part of the cryptocurrency’s recurring cycles rather than signs of a faltering narrative. Reflecting on past trends, Morehead emphasized the cyclical nature of the crypto market, where periods of exuberance transition into downturns.

Understanding Bitcoin’s Cyclical Nature

Morehead shared an example from Pantera Capital’s past predictions, highlighting the accuracy of their projections, including a forecasted Bitcoin price hit in 2025. This alignment with historical patterns reinforces his belief in Bitcoin’s long-term trajectory.

Emerging Channels of Bitcoin Demand

Morehead identified new channels, such as publicly listed ETFs and digital treasury companies, as significant contributors to recent Bitcoin demand. These entities have collectively invested substantial sums, suggesting a maturing market where institutional involvement is growing.

The Case for Bitcoin as a Hedge Against Monetary Debasement

Morehead also emphasized Bitcoin’s role as a safeguard against the erosion of fiat currencies. He points to ongoing monetary debasement as a compelling reason for investors to allocate assets into Bitcoin, with its fixed supply offering a stable alternative to traditional currencies eroded by inflation.

Bitcoin Versus Gold: A Comparative Outlook

Addressing the ongoing debate between gold and Bitcoin, Morehead highlighted the increasing institutionalization of both assets. He noted that ETF inflows for gold and Bitcoin have been comparable, reinforcing his belief that Bitcoin will significantly outperform gold over the next decade.

Institutional Interest: A Bullish Indicator

Morehead views skepticism within major institutions as a positive signal for Bitcoin’s future. He observes that institutional holdings remain minimal, suggesting substantial room for growth as adoption expands.

Editorial Integrity and Review Process

Editorial Process: The editorial approach at bitcoinist is dedicated to providing meticulously researched, accurate, and unbiased content. Our commitment to high sourcing standards ensures each article undergoes rigorous evaluation by leading technology experts and experienced editors. This stringent process guarantees our readers receive valuable and relevant information.

At the time of writing, Bitcoin is trading at $69,418.

“`