Expert Insights: Safeguarding Your XRP Investments with Tax Strategies

Our trusted editorial team, composed of top industry experts and experienced editors, brings you thoroughly researched content. We uphold transparency and accuracy in all our articles.

Understanding Critical Tax Information for XRP Investors

Renowned crypto expert Jake Claver has highlighted vital tax considerations for XRP investors, offering insights that could be pivotal in wealth protection. Claver suggests that these strategies may be particularly beneficial as XRP’s value potentially rises to $100. His insights, shared through his company, Digital Ascension Group (DAG), underscore the importance of understanding tax implications for XRP holders.

Impact of Cryptocurrency’s Classification as Property

In a revealing post, Claver discussed how the IRS’s 2014 decision to classify cryptocurrencies as property reshaped the landscape for crypto investors. According to DAG, many XRP holders with substantial assets may not fully grasp the ramifications of this classification. Since crypto is deemed property, it is susceptible to court orders, meaning personal legal issues could result in a court mandating the turnover of wallet keys.

Conversely, this classification opens avenues for wealth strategies long utilized by real estate magnates. By implementing a step-up basis at death, heirs can inherit XRP at its current market value without incurring capital gains taxes. For instance, XRP purchased at $0.50 and valued at $100 upon the investor’s death would be transferred to heirs with capital gains erased.

Leveraging XRP Holdings for Financial Flexibility

DAG further elaborated on how XRP holders could leverage their assets without selling. By taking loans against their holdings at competitive interest rates, investors can maintain liquidity while sidestepping hefty tax liabilities. This strategy mirrors how Elon Musk financed Twitter’s acquisition using borrowed funds against Tesla shares, paving the way for similar tactics in the crypto domain.

Strategies to Secure XRP Wealth

To fortify their crypto portfolios, DAG recommends transferring XRP assets into a Wyoming LLC. This move provides charging order protection, safeguarding assets from creditors who must wait for distributions that investors need not execute. The corporate structure effectively shields investors from unwanted liability.

Maximizing Tax Benefits through Gifting

Investors can also benefit from gifting strategies. By filing Form 709, they can gift up to $13.6 million to family members tax-free, thereby moving wealth outside the taxable estate. Couples can jointly transfer up to $27.2 million without incurring gift taxes, optimizing their financial legacy.

Moreover, placing the LLC into a revocable living trust ensures seamless asset transition. Upon the investor’s passing, the spouse becomes the trustee, bypassing probate delays and fees while maintaining privacy over crypto assets.

Long-Term Wealth Structuring for Crypto Investors

DAG emphasizes that while many retail investors treat crypto as speculative bets, affluent families approach it akin to commercial real estate. By structuring, protecting, and borrowing against these appreciating assets without selling, they lay the groundwork for generational wealth. Understanding the property classification is key to unlocking these wealth-building strategies.

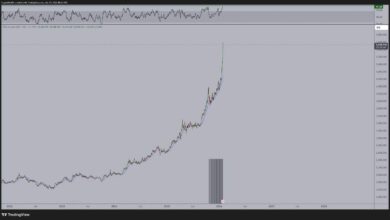

As of now, XRP trades at approximately $1.98, having experienced a 7% decline in the past 24 hours, according to CoinMarketCap data.

Our Editorial Commitment

At Bitcoinist, our editorial process is dedicated to delivering meticulously researched, accurate, and unbiased content. Our team of seasoned technology experts and editors ensures each page undergoes comprehensive review, maintaining the integrity, relevance, and value of our content for our readers.

“`