Ex-CFO’s Cryptocurrency Scheme Ends in Conviction

Unraveling a Cryptocurrency Investment Fraud

The US Attorney’s Office for the Western District of Washington has disclosed the conviction of Nevin Shetty, a former Chief Financial Officer accused of wire fraud. Shetty, 41, from Mercer Island, Washington, was found guilty of misappropriating $35 million from his previous employer, a private software firm. His tenure as CFO began in March 2021, during a period of active fundraising by the company.

The Company’s Investment Strategy

The software firm had implemented a conservative investment strategy, stipulating that the newly acquired funds should only be allocated to money market accounts and other low-risk investments. This approach was intended to support the company’s ongoing business enhancements.

Violation of Trust

Contrary to the agreed policy, Shetty diverted $35 million into HighTower Treasury, a cryptocurrency investment platform he co-founded in February 2022. The Department of Justice revealed that Shetty’s actions came after the company expressed concerns about his job performance, suggesting a potential termination package.

Details of the Unauthorized Transfer

In March 2022, Shetty was informed of his impending dismissal as CFO. Seizing the opportunity, he covertly transferred $35,000,100 from the company’s account to HighTower Treasury between April 1 and 12. None of the other company executives or board members were aware of these transactions.

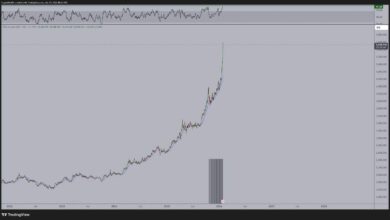

The Ill-Fated Investment

The funds were invested in a high-yield Decentralized Finance (DeFi) lending protocol, which promised a 20% return on investment. The plan was to distribute 6% back to the company while retaining 14% as profit for HighTower Treasury. Initially, the investment generated $133,000 in the first month. However, it soon suffered losses, leading to a complete depletion of funds by May 13, 2022.

Aftermath and Investigation

Following the revelation of his actions, Shetty was immediately terminated. The company subsequently reported the incident to the FBI, triggering a comprehensive investigation into the fraudulent activities.

Awaiting Justice

Shetty faced trial and was convicted on November 7, 2025, for four counts of wire fraud. The jury reached its decision after deliberating for 10 hours over nine days. US District Judge Tana Lin has scheduled Shetty’s sentencing for February 11, 2026. Although each count of wire fraud carries a potential sentence of 20 years, the final sentence will depend on various factors, including the scale of financial loss and Shetty’s role in the crime.

Potential Sentencing

While the aggregate sentence could theoretically reach 80 years, federal sentences often run concurrently. The judge will consider the US Sentencing Guidelines, which weigh factors such as the amount of loss, the defendant’s role in the fraud, and any prior criminal history.

Commitment to Editorial Integrity

At Bitcoinist, we prioritize delivering meticulously researched and unbiased content. Our rigorous editorial process involves comprehensive reviews by leading technology experts and seasoned editors, ensuring that our readers receive accurate and valuable information.