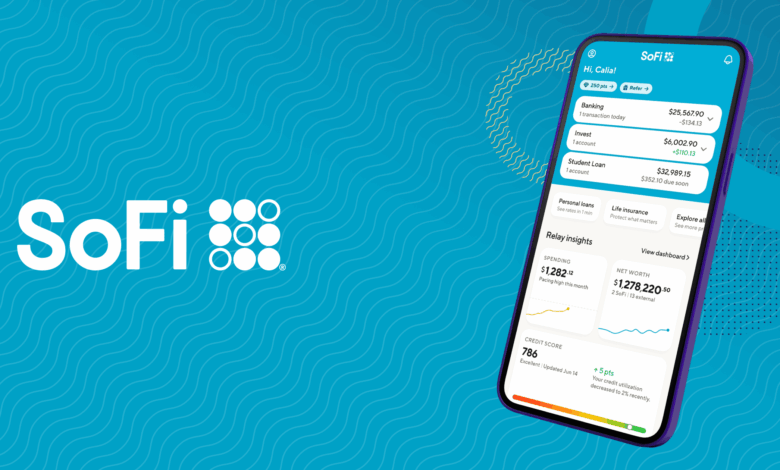

SoFi Expands Financial Horizons with Cryptocurrency Integration

SoFi, a leading financial technology firm recognized for its national banking charter, has taken a significant leap by enabling its U.S. customers to engage in cryptocurrency transactions directly within its app. This innovative feature, announced on November 11, 2025, promises to offer a wide range of tokens, including prominent names such as Bitcoin, Ethereum, and Solana.

Seamless Banking and Cryptocurrency Trading in One Platform

SoFi’s latest investor release reveals that its products are currently utilized by approximately 12.6 million members. The integration of cryptocurrency trading will be gradually introduced to this user base over the coming weeks. This new feature facilitates the direct transfer of funds from SoFi checking or savings accounts to cryptocurrency transactions without necessitating the creation of a separate account.

CEO Highlights Significance of Banking-Crypto Integration

According to SoFi’s CEO, Anthony Noto, this development represents a transformative moment where traditional banking converges with the future of money. He emphasized the importance of offering members a secure and regulated pathway into the evolving financial landscape. As part of the launch, SoFi is introducing a waitlist promotion, allowing users who sign up by November 30 to receive priority access. Participants meeting certain activity criteria by January 31, 2026, stand a chance to win one Bitcoin.

Regulatory Guidance Facilitates SoFi’s Crypto Services

The decision to integrate cryptocurrency services follows updated guidance from federal regulators in 2025. Notably, an action by the Office of the Comptroller of the Currency in spring 2025 simplified the process for banks holding national charters to offer crypto and blockchain services. This regulatory shift has been pivotal for SoFi’s strategic move.

Surveys conducted by SoFi indicate that around 60% of its crypto-owning members prefer to hold their assets with a licensed bank rather than a crypto-native exchange. The allure of trust and seamless money movement are compelling factors driving customer interest.

Beyond Trading: SoFi’s Vision for Cryptocurrency

SoFi’s ambitions extend beyond simple trading. CEO Anthony Noto has outlined several initiatives, including the development of a U.S. dollar stablecoin, blockchain-enabled remittances, and integration of cryptocurrency into lending solutions. With a robust third-quarter performance boosting its full-year profit forecast, SoFi is well-positioned to expand its service offerings.

Industry analysts predict that banks and fintech companies will keenly observe SoFi’s approach. While some may attempt to replicate the one-app strategy, crypto exchanges might highlight their own strengths in features and fees. Nevertheless, it’s important to note the inherent volatility of cryptocurrencies, and SoFi explicitly states that assets purchased are not FDIC insured.

As the cryptocurrency market cap reaches $3.43 trillion, the landscape continues to evolve, offering both opportunities and challenges for financial institutions.

Commitment to Editorial Excellence

The editorial process at Bitcoinist is meticulously designed to deliver content that is thoroughly researched, accurate, and unbiased. Upholding rigorous sourcing standards, each article undergoes a comprehensive review by top technology experts and seasoned editors. This dedication ensures the content’s integrity, relevance, and value for our readers.