Exploring the Solana Staking ETF: A New Era in Crypto Investment

Our editorial content is crafted with care and precision by industry leaders and experienced editors, ensuring the highest standards of quality and trustworthiness. Note: This article contains a disclosure on advertisement partnerships.

Bitwise Asset Management’s Bold Move: Introducing Solana Staking ETF

Bitwise Asset Management has recently revamped its Solana exchange-traded fund (ETF) proposal by incorporating “Staking” into the fund’s title. Additionally, they have revealed a remarkably low unitary sponsor fee of 0.20%, which stands out as one of the most competitive fees for a US cryptocurrency ETF. This update was highlighted by Bloomberg’s James Seyffart, who noted the filing adjustments late Wednesday.

Seyffart further elaborated that the fund will not incur any fees for the initial three months or until the first $1 billion in assets under management is reached. This strategy is reminiscent of the fee reduction tactics that significantly boosted spot bitcoin ETFs earlier this year. Eric Balchunas, another Bloomberg analyst, emphasized the aggressive pricing strategy: “Bitwise is not holding back, offering just a 0.20% fee for their spot Solana ETF.”

Uncertain Launch Timeline for Solana Staking ETF

The recent amendment suggests that both issuers and the Securities and Exchange Commission (SEC) have made progress in resolving the structural issues related to spot Solana products that include staking, a unique feature of proof-of-stake assets. Earlier this year, the SEC directed potential Solana ETF sponsors to revise their S-1 registration statements, a move generally seen as a precursor to launching once policy questions are addressed.

The timeline for the ETF launch remains uncertain. The US government shutdown that began on October 1 has severely limited the SEC’s operational capacity, with over 90% of its staff furloughed. This has delayed non-essential reviews and slowed the approval process for a wide range of securities registrations. As a result, the effective dates for crypto ETFs might be postponed despite ongoing paperwork. Seyffart commented on the situation, stating that the shutdown could indeed delay approval.

Competitive Pricing Strategy in the ETF Market

Despite these challenges, Bitwise’s pricing strategy reflects a confident approach to capturing market share. With a 20-basis-point fee, the proposed Solana Staking ETF aligns with the lower fee spectrum that facilitated the widespread adoption of bitcoin ETFs. This pricing strategy is part of a broader trend where low fees have consistently attracted investors, a pattern observed across cryptocurrency exchange-traded products (ETPs).

The next steps will depend on two critical factors. Procedurally, the SEC must approve the updated S-1 registration statements before trading can commence. Practically, the duration of the government shutdown will influence when the SEC staff can complete their reviews. Strategically, Bitwise’s decision to highlight staking in the fund’s name and adopt an ultra-low fee positions it advantageously against rival Solana filings. When the government reopens, the product will be poised to meet the anticipated demand.

Competition and Key Dates in the Solana ETF Landscape

Alongside Bitwise, other potential spot Solana ETF issuers on the SEC’s agenda include VanEck, 21Shares, and Canary, each facing final decision dates on October 16, 2025. Grayscale is also in the mix with its proposed conversion of its Solana trust, which has an earlier deadline of October 10, 2025. Additionally, Franklin Templeton’s date is set for November 14, 2025, Fidelity’s for December 5, 2025, and Invesco Galaxy’s product stretches to April 16, 2026. These dates correspond to the SEC’s 19b-4 timeline initiated when Cboe first filed to list the SOL ETFs, though S-1 effectiveness remains a prerequisite for trading.

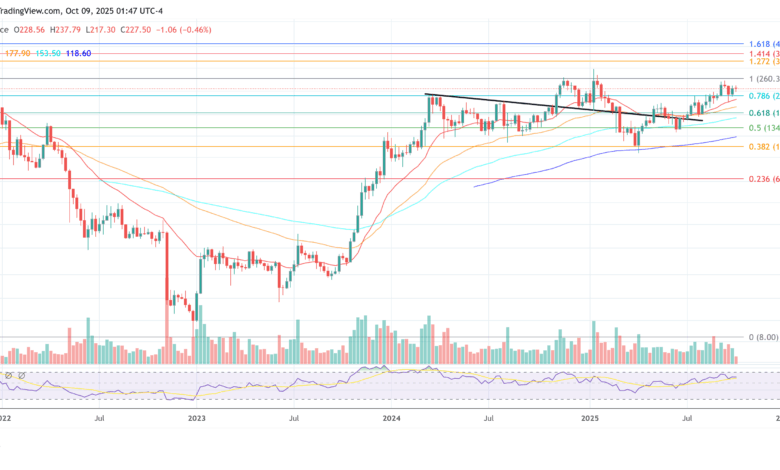

At the time of writing, Solana (SOL) is trading at $227.

Our Editorial Commitment

At Bitcoinist, our editorial process is dedicated to providing meticulously researched, accurate, and unbiased content. We adhere to stringent sourcing standards, ensuring that every page undergoes thorough review by our team of leading technology experts and seasoned editors. This rigorous process guarantees the integrity, relevance, and value of our content for our readers.

“`