Ethereum’s Market Dynamics: A Deep Dive into Current Trends

Ethereum has recently entered a phase of significant volatility, following its breakthrough past the all-time highs set in 2021. This development has sparked both excitement and caution throughout the cryptocurrency market. After the initial surge, Ethereum’s price retraced, testing pivotal demand levels where buyers stepped in to secure support. The bulls are demonstrating resilience, and some analysts are optimistic about Ethereum’s potential to rally beyond the $5,000 mark in the near future.

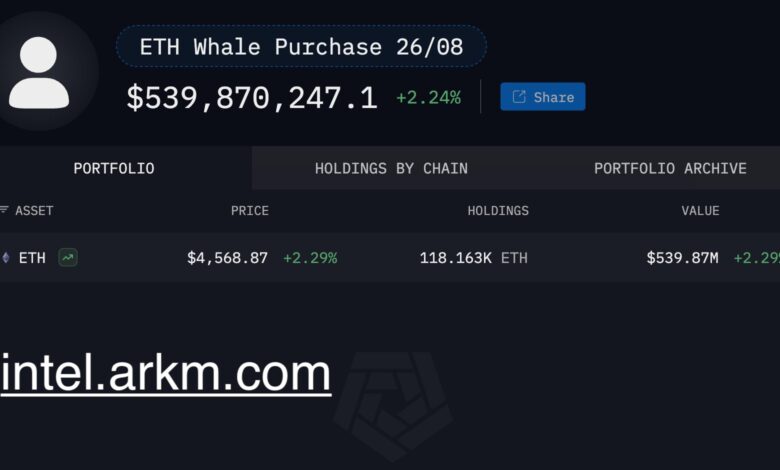

However, the prospect of a more substantial correction casts a shadow of uncertainty over traders and investors. There is a growing sentiment of fear, as questions arise over the sustainability of Ethereum’s rally and the possibility of another downturn. Yet, amidst this atmosphere, one undeniable pattern is emerging: the accumulation by whales. According to Arkham Intelligence, nine whale addresses collectively acquired approximately $450 million worth of Ethereum in a single day. This significant move indicates confidence from major market participants, highlighting how large investors are capitalizing on price retracements, potentially gearing up for the next upward movement.

Significance of Ethereum Whales in the Market

Data from Arkham Intelligence reveals that Ethereum whales are making strategic moves that could influence the market’s next phase. Specifically, nine large addresses collectively purchased $456.8 million worth of ETH in just one day. Among these, five wallets received their inflows directly from Bitgo, a renowned institutional custodian, while the remaining four made their acquisitions through Galaxy Digital’s over-the-counter (OTC) desk. These transactions not only demonstrate the confidence of individual whales but also underscore the increasing role of institutional-grade platforms in enabling substantial Ethereum acquisitions.

This surge in whale activity underscores a crucial market dynamic: investors with significant financial resources are positioning themselves for what might be the next upward leg in Ethereum’s price cycle. Historically, whale accumulation during volatile periods has often preceded notable upward momentum, laying a robust foundation for bullish narratives. With Ethereum already testing critical demand zones following its breakout above the 2021 all-time highs, these inflows may help stabilize price action and build momentum toward new, uncharted territories.

Beyond whale activities, public companies are also making their presence felt. Companies such as Bitmine and Sharplink Gaming have recently disclosed their Ethereum holdings, further validating ETH’s stature as an institutional-grade asset. This mirrors the early corporate adoption phase of Bitcoin, where public companies added BTC to their balance sheets, bolstering market confidence.

When combined, the impact of whale accumulation, institutional OTC purchases, and public company adoption creates a compelling narrative: confidence in Ethereum’s long-term trajectory is growing stronger. Despite short-term risks, these trends fortify a bullish outlook for ETH to move toward price discovery and potentially exceed the $5,000 benchmark. The market is closely monitoring these developments, with whales and institutions seemingly at the forefront of this charge.

Ethereum’s Bullish Outlook Toward $5,000

Ethereum is currently trading at approximately $4,592, having rebounded from a sharp retrace off local highs near $4,850. The 4-hour chart indicates that ETH is regaining strength above the 50-day and 100-day moving averages, signaling that buyers are re-entering the market to defend crucial levels. This resurgence restores confidence in the short-term uptrend, even as volatility remains a significant concern for traders.

Looking at the broader picture, the outlook is supportive. With the 200-day moving average positioned at $4,119, Ethereum’s resilience is highlighted despite recent fluctuations. Maintaining a position above the faster averages not only stabilizes momentum but also sets the stage for another attempt at resistance. The primary barrier ahead is at $4,800, where sellers previously halted the rally. A decisive breakthrough here could pave the way toward the $5,000 milestone, a level analysts believe could ignite renewed enthusiasm and potentially initiate a new phase of price discovery.

Nevertheless, the possibility of another pullback remains. Should the price drop below $4,400, ETH might revisit the $4,200 demand zone, where previous buying pressure was observed. For now, however, sentiment leans cautiously bullish. Whales continue to accumulate, technical indicators remain favorable, and Ethereum seems poised to test higher levels if momentum persists.

The editorial process at Bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page undergoes rigorous review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.