Expertly Curated Editorial Content with Industry Insights

Our content is carefully evaluated by top-tier industry experts and experienced editors to ensure accuracy and reliability. Ad Disclosure

Bitcoin Dominance and Its Market Implications

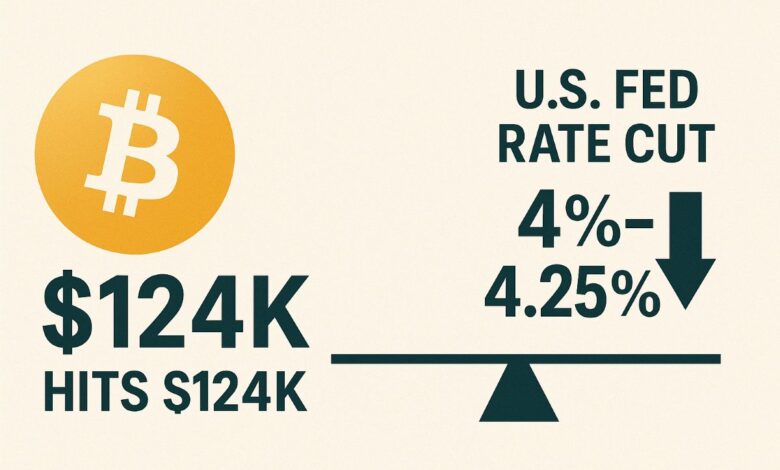

Bitcoin (BTC) stands as the largest cryptocurrency, commanding an impressive 58.6% of the total market share. Recently, BTC soared to an all-time high of $124,000, fueled by speculations surrounding a potential interest rate cut by the US Federal Reserve in September. Such macroeconomic factors invariably drive interest in risk assets like BTC.

Despite its rising popularity, questions about the Bitcoin network’s ability to manage increased activity persist. However, the emerging Bitcoin Hyper (HYPER) Layer 2 solution promises to address these challenges and is nearing its $10 million presale target, currently only $300,000 short.

Impact of Federal Rate Cut on Bitcoin

The CME Group’s FedWatch tool indicates a 92.5% probability of an interest rate cut by the Federal Reserve, potentially lowering rates to between 4% and 4.25% for the first time since December 2024. Lower borrowing costs often encourage investment in high-yield, risk-on assets such as BTC, which is currently valued at $118,000.

This development is part of a broader optimistic trend for BTC. For instance, US-listed spot Bitcoin ETFs hold a staggering $170.22 billion in assets, with BlackRock’s iShares Bitcoin Trust (IBIT) alone managing $86.83 billion.

The influx of institutional capital into BTC reduces its availability, enticing long-term holders and increasing its potential for further appreciation. Additionally, the US has adopted a supportive stance on cryptocurrency, with legislative initiatives like the ‘GENIUS Act’ and ‘Clarity Act’ aiming to enhance transparency around digital assets. ‘Project Crypto’ is also set to modernize securities laws, facilitating Web3 innovation.

The US Bitcoin Reserve, designed to maintain the nation’s leadership in the crypto sector and act as an economic hedge, further underscores BTC’s impact. Treasury Secretary Scott Bessent’s statement on the government’s BTC holdings briefly affected the market cap, but later clarifications restored confidence.

These developments fortify BTC’s outlook, encouraging institutional adoption and bolstering market confidence, even amid volatility. The pressing question remains whether the Bitcoin network can scale to accommodate the anticipated surge in activity.

Challenges of Bitcoin’s Scalability and Smart Contract Capabilities

The Bitcoin network is not optimized for speed and can process only about 7 transactions per second (tps), compared to Ethereum’s 15–30 tps and Solana’s 1,000 tps. Bitcoin’s block size is limited to 1MB, and its 10-minute block time often leads to high transaction fees during peak demand periods.

In contrast, Ethereum benefits from quicker block times and a dynamic block size mechanism, with an average block size of approximately 123,024 bytes. This adaptability supports higher throughput, efficiently managing network demand and hosting a diverse array of decentralized finance (DeFi) protocols, decentralized applications (dApps), and non-fungible tokens (NFTs).

Bitcoin’s primary focus is security, which restricts its ability to support complex smart contracts or host extensive DeFi and NFT ecosystems, unlike Ethereum. Consequently, Ethereum boasts the largest Total Value Locked (TVL) at $94.356 billion, significantly surpassing Bitcoin’s $7.63 billion.

Bitcoin Hyper aims to address these issues by providing a much-needed upgrade.

Bitcoin Hyper Layer 2: Enhancing Bitcoin’s Capabilities

Set for release this quarter, Bitcoin Hyper is poised to revolutionize the Bitcoin network by increasing speed, reducing costs, and enhancing its compatibility with DeFi. By batching transactions off-chain and settling them on Bitcoin’s base layer, Bitcoin Hyper aims to decrease block space competition, lower fees, and provide near-instant confirmations.

Additionally, the integration with the Solana Virtual Machine (SVM) will enable smart contract functionality on Bitcoin, opening opportunities for DeFi protocols, dApps, and meme coins. A Canonical Bridge will facilitate the verification of SVM smart contracts and the minting of wrapped BTC on Layer 2 for use on DeFi platforms.

Security remains a priority, with Bitcoin Hyper utilizing Zero-Knowledge Proofs (ZKPs) for fast, trustless transaction verification, preventing blockchain congestion.

Bitcoin Hyper Presale Approaches $10 Million Amid Rising BTC Demand

With macroeconomic factors, institutional interest, and favorable crypto policies driving BTC’s growth, the need for network upgrades is more crucial than ever. Bitcoin Hyper is well-timed to enhance the Bitcoin network as global BTC adoption accelerates.

For those looking to maximize benefits within the Bitcoin Hyper ecosystem, such as lower fees and governance rights, the presale offers $HYPER at $0.012725. The presale has already garnered over $9.7 million, indicating strong investor interest.

Please note that this information is not financial advice. Always conduct your own research (DYOR) and invest responsibly.

Commitment to Editorial Excellence

Editorial Process: At Bitcoinist, we prioritize delivering meticulously researched, accurate, and unbiased content. Our rigorous sourcing standards and thorough review process by top technology experts and seasoned editors ensure the integrity, relevance, and value of our articles for our readers.