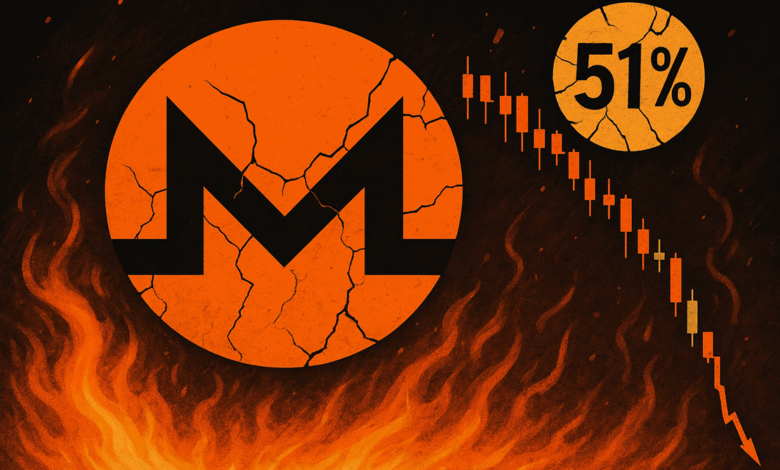

Monero Faces Alleged 51% Attack from Qubic Mining Pool

Monero (XMR), a noteworthy cryptocurrency known for its privacy features, is reportedly under siege from a potential 51% attack by the Qubic mining pool. Prominent figures on social media have raised alarms about this situation. Bitcoin developer Peter Todd commented on the development, stating, “Interesting. Apparently, Monero just had a big reorg too, I assume related to this attack.” However, Todd also highlighted the challenges in confirming whether Qubic has indeed surpassed the 51% threshold, noting, “That’s inherently difficult to measure. PoW is probabilistic.”

Qubic Mining Pool Claims Dominance Over Monero

An account known as Coffeinated User has been circulating information about Qubic’s alleged control over Monero. The post claims, “Qubic just reached a 51% share of Monero. This is a significant achievement. They will be the first to manipulate a cryptocurrency with a 51% attack. Their plan is to orphan all blocks from other miners, making Qubic the sole mining entity for Monero.” Additionally, the post discusses a profit-sharing mechanism involving QUBIC tokens: “They are three times more profitable than mining Monero directly. Half the profit is given to miners, while the other half is used to purchase QUBIC and send it to the burn wallet.”

Economic Implications of the Alleged Attack

The post provides a detailed breakdown of the potential financial outcomes: “If they mine 100% of Monero blocks, they could earn 432 Monero per day, equivalent to approximately $118,342.08 at current prices. They retain 50% of this and distribute the rest to miners, resulting in $59,171.04 worth of Qubic being burned daily, $414,197.28 weekly, and $1.656 million monthly.” The narrative further contrasts Qubic’s market cap with Monero’s: “With a market cap of less than $300 million, Qubic could potentially dominate a $6 billion market cap coin.”

Community Response and Strategic Mobilization

The Monero community, represented by the account @monerobull, described the situation as unprecedented, urging miners to increase hash-rate support: “Monero just experienced its deepest re-org ever. Everyone head to gupax.io and start mining. qtip has a halving in 20 days, after which they won’t be able to sustain this attack.”

Industry Perspectives and Potential Outcomes

Charles Guillemet, CTO at Ledger, offered a comprehensive analysis, “Monero appears to be facing a successful 51% attack.” He linked this to Monero’s history of adversaries and exchange de-listings, adding, “The privacy-centric blockchain, launched in 2014 and often targeted by governments and three-letter agencies, is banned from most major centralized exchanges.” Guillemet also noted, “The Qubic mining pool has amassed significant hashrate, enabling them to control the network, potentially allowing for blockchain rewriting and transaction censorship.”

Financial and Market Impact

Guillemet provided a staggering cost estimate for sustaining the attack: “It’s estimated to cost $75 million daily.” He warned about the diminishing incentives for honest miners: “Other miners are left with no incentive to continue, as Qubic can orphan any competing blocks, effectively monopolizing mining.” Highlighting the market dynamics, he noted, “A $300 million market-cap chain is overtaking a $6 billion one. Monero’s recovery options are limited, with a full takeover now plausible.” Despite these challenges, the XMR value has only dropped by 13% so far.

Qubic’s Perspective and Future Outlook

Within the Qubic project, Sergey Ivancheglo, also known as “Come-from-Beyond,” expressed both pride and a need for independent verification: “Looks like #Qubic has achieved 51% over #Monero, we are waiting for independent confirmations. Meanwhile, the #Monero team is fine-tuning their 51% attack protection.”

Addressing previous accusations of ulterior motives, Ivancheglo stated, “Many accused us of being sponsored by three-letter agencies to attack this anonymous coin. What do you think now, after we have helped Monero prepare for its future battles against those agencies?”

As Peter Todd emphasizes the probabilistic nature of Proof of Work (PoW) and the difficulties in real-time dominance verification, claims from both critics and supporters suggest that Monero is indeed grappling with a live, majority-hashrate challenge, with its community actively working to counteract the threat.

At the time of reporting, Monero (XMR) was trading at $252.

Quality Assurance in Editorial Process

The editorial process at bitcoinist prioritizes delivering well-researched, factual, and unbiased content. We adhere to rigorous sourcing standards, with each article undergoing meticulous review by our team of technology experts and seasoned editors. This commitment ensures our content’s integrity, relevance, and value to our readers.