Arthur Hayes Offloads $13 Million in Crypto Assets: What Does This Mean for the Market?

A Comprehensive Analysis of Hayes’ Recent Cryptocurrency Sales

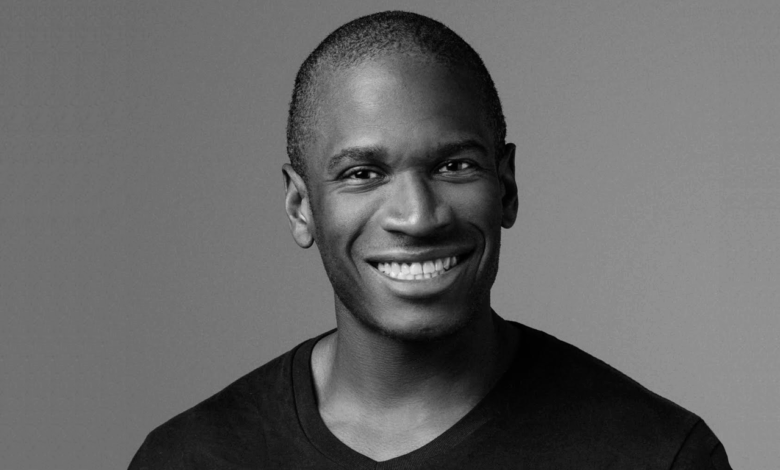

Arthur Hayes, co-founder of BitMEX and a pivotal figure in the cryptocurrency space, has recently executed a significant sale of various crypto assets, amounting to $13 million. This move comes amid a general downturn in the crypto market, which has raised questions and discussions within the industry. Hayes has offered detailed insights into the reasoning behind this cautious approach to current market conditions.

Reasons Behind the Sell-Off: Predictions and Economic Indicators

On August 2, LookonChain, a trusted analytics firm, reported that Hayes had sold approximately $13 million worth of cryptocurrencies during a market correction phase. This sale included 2,373 Ethereum (ETH) valued at $8.32 million, 7.76 million Ethena (ENA) worth $4.62 million, and 38.86 billion Pepe (PEPE) totaling $414,600. These transactions were completed within a six-hour timeframe, highlighting the urgency and strategic nature of the move.

Recently, the market has witnessed a decline, with Ethereum and PEPE experiencing price drops of 2.70% and 3.03%, respectively, influenced by Bitcoin’s dip below $113,000. ENA also faced a 10.98% decrease after initially experiencing a remarkable 24% rise between July 30 and 31. Hayes’ decision to offload these assets is rooted in his analysis of macroeconomic trends, forecasting that the global economy is approaching a phase of heightened pressure.

Global Economic Outlook and Its Impact on Cryptocurrencies

Hayes attributes his market decisions to several converging factors. He points to the delayed financial repercussions of US tariffs manifesting in the third quarter, coupled with indications of a weakening labor market as revealed by recent non-farm payroll statistics. Moreover, Hayes argues that no major global economy is currently expanding credit at a pace sufficient to stimulate nominal GDP growth. This scenario could expose the global economic system to deflationary risks and potential market reevaluation.

Against this backdrop, Hayes anticipates a shift in capital away from volatile assets such as cryptocurrencies. This expectation has informed his recent market strategy. However, Hayes remains optimistic about future price trajectories, projecting Bitcoin to reach $100,000 and Ethereum to climb back to $3,000. Should these predictions materialize, further market corrections are likely to ensue.

Current Cryptocurrency Market Overview

The cryptocurrency market is currently navigating a challenging landscape, with fluctuating prices and varying investment strategies. As market dynamics continue to evolve, stakeholders must stay informed about the underlying economic indicators and strategic decisions made by key industry players like Arthur Hayes. Understanding these factors is crucial for navigating the complexities of the crypto market and anticipating future trends.

Our Editorial Integrity

At Bitcoinist, our editorial approach is grounded in delivering well-researched, accurate, and impartial content. We adhere to rigorous sourcing standards, with each article undergoing thorough review by a team of top technology experts and experienced editors. This meticulous process ensures that our content maintains its integrity, relevance, and value for our readership.