Strategy’s Bold Move: Embracing Bitcoin as a Core Business Model

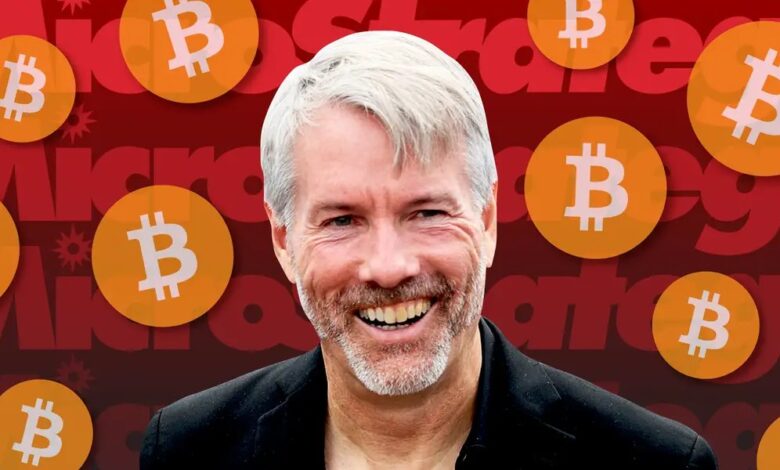

In a transformative shift, Strategy, formerly known as MicroStrategy, is fully integrating Bitcoin into its business operations. Michael Saylor, the Executive Chairman, recently discussed this strategic pivot on CNBC’s “Squawk Box.” This move signifies more than just holding the cryptocurrency; it’s about building the company’s future around Bitcoin.

Understanding Bitcoin as “Digital Capital”

Michael Saylor has characterized Bitcoin as “digital capital,” and Strategy’s investment in it is substantial. The company has amassed over 628,000 BTC, valued at approximately $72 billion, representing nearly 3% of the total Bitcoin supply. This massive acquisition was partly funded through an impressive $2.5 billion raised from an IPO of Series A Perpetual Preferred Stock, with 28 million shares sold at $90 each. Part of these funds facilitated the purchase of 21,021 BTC on July 29.

Innovative Fundraising: Bitcoin-Focused IPOs

This year, Strategy conducted four fundraising rounds, two of which secured $500 million each, with another raising $1 billion. The most recent and significant offering raised $2.5 billion, marking the largest IPO of 2025 by gross proceeds. This innovative business model involves raising capital specifically for Bitcoin acquisition, transforming volatile digital assets into securities that attract professional investors. The new offering, named “Stretch” (STRC), is hailed by Saylor as the company’s most thrilling product to date.

The Rising Trend of Bitcoin Adoption Among Public Companies

Michael Saylor also highlighted the growing trend of public companies integrating Bitcoin into their reserves. Currently, over 160 publicly traded companies have adopted Bitcoin, a stark increase from approximately 60 a year ago. Collectively, public companies hold around 955,048 BTC, accounting for 4.55% of the total Bitcoin supply. Saylor believes Bitcoin is gradually replacing traditional assets such as gold, real estate, and equities as a preferred store of value. For companies aiming to enhance shareholder value, he argues that investing in Bitcoin is more advantageous than holding cash or investing in conventional assets like private equity.

Strategy’s Approach: Sharing the Bitcoin Wealth

Although Strategy holds a significant portion of Bitcoin, Saylor clarified that the company is not attempting to monopolize the Bitcoin market. He considers owning 3% to 7% of the supply reasonable, emphasizing the importance of allowing others to participate in the Bitcoin economy. He noted that BlackRock, via its iShares Bitcoin Trust (IBIT), holds a larger quantity of BTC, approximately 740,896. Saylor also referenced the limitations imposed by SEC regulations, which prevent large tech firms such as Apple and Microsoft from investing in each other’s stocks or S&P 500 companies. Without these restrictions, Saylor speculates that these tech giants might consider investing in each other and possibly in Bitcoin.

This strategic shift by Strategy highlights the evolving landscape of corporate investments, with Bitcoin playing a pivotal role. As more companies recognize the potential of digital assets, the business world may see a significant transformation in investment strategies and asset management.

“`