Potential Bitcoin Inflows with New US Sovereign Wealth Fund

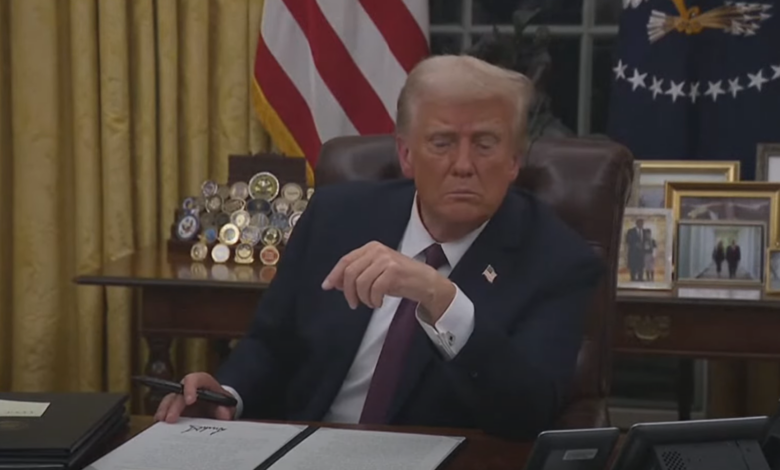

Bitcoin is poised to experience remarkable capital inflows, estimated to range from $150 billion to $500 billion, following the signing of an executive order by US President Donald Trump. This order mandates the establishment of a new sovereign wealth fund, to be managed by US Secretary of Commerce Howard Lutnick and US Secretary of the Treasury Scott Bessent. Although the announcement did not specifically mention Bitcoin, the backgrounds of Lutnick and Bessent have sparked speculation about the inclusion of digital assets in the fund.

The US Sovereign Wealth Fund: A Game Changer

The creation of the US sovereign wealth fund (SWF) is anticipated within the coming year. Market analysts highlight both Lutnick’s and Bessent’s supportive stance on Bitcoin, which fuels conjecture that the SWF may incorporate digital currencies. This initiative has the potential to transform the financial landscape, drawing significant interest from the cryptocurrency community.

Why $150 Billion Bitcoin Inflows Are Plausible

Prominent Bitcoin advocate Florian Bruce-Boye has offered an optimistic perspective on the US sovereign wealth fund’s future impact, suggesting it could evolve into the largest sovereign wealth fund globally. Bruce-Boye envisions the fund reaching $2 trillion in the long run, paralleling the current market size of Bitcoin.

He attributes this potential to the investment philosophies of Lutnick and Bessent, both of whom are known for their favorable outlook on Bitcoin. Lutnick has reportedly invested hundreds of millions in BTC and is known for purchasing during market dips, while Bessent views Bitcoin as a technology of freedom. Bruce-Boye draws comparisons to Norway’s $1.8 trillion fund and Saudi Arabia’s $1 trillion fund, emphasizing that similar investments could significantly boost Bitcoin’s market capitalization.

Bruce-Boye further calculates that a mere 3% allocation from a combined $4.8 trillion fund could equate to $150 billion in Bitcoin investments, approximately 1.5 million BTC at current prices. He advises those unfamiliar with Bitcoin to delve deeper into its potential.

Or Even $500 Billion?

Apollo co-founder Thomas Fahrer offers a more bullish projection, suggesting that the US sovereign wealth fund could swiftly reach $5 trillion in assets under management (AUM). Fahrer argues that a 10% allocation to Bitcoin is logical, potentially resulting in $500 billion in BTC purchases over the coming years.

Jeff Walton, a digital capitalist and founder of True North, stresses the significance of Howard Lutnick’s involvement. Lutnick, who also serves as CEO of Cantor Fitzgerald, has made substantial personal investments in Bitcoin. Walton highlights Lutnick’s ambitions for Cantor Fitzgerald, including launching a $2 billion Bitcoin financing lending business and supporting Bitcoin through innovative financial platforms.

As the global Bitcoin market anticipates further developments, even a modest allocation from the anticipated US sovereign wealth fund could reshape the digital currency landscape, potentially heralding a new era of institutional participation worldwide.

At the time of writing, Bitcoin is trading at $99,450.