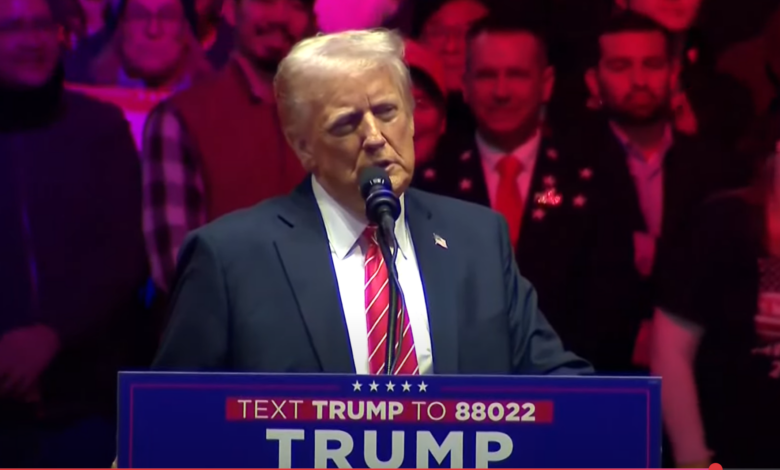

Donald Trump’s Entry into Cryptocurrency: TRUMP Coin and Its Legal Implications

In a surprising move, Donald Trump has ventured into the cryptocurrency sphere by introducing his own meme coin, TRUMP. This development has stirred legal discussions and debates within the financial and crypto communities. A notable cryptocurrency and finance attorney, Anonwassielawyer, has delved into this matter, providing insights into why Trump’s initiative, although unconventional, aligns with the current U.S. securities regulations.

Understanding Memecoins: Did Trump Exploit a Securities Law Loophole?

Anonwassielawyer provocatively questions, “Did Trump’s meme coin, skyrocketing to over $70 billion, signal a shift in legal boundaries?” Through his analysis, he highlights that the distinction between securities and non-securities in U.S. law has long been established, allowing for such launches. Memecoins, typically devoid of tangible utility or profit-sharing features, often fall outside the “investment contract” category defined by the Howey Test.

The Howey Test and Memecoins

For a digital asset to be considered a security, it must fulfill certain criteria: an investment of money, in a common enterprise, with profits expected from the efforts of others. Memecoins like TRUMP, however, lack these characteristics. Anonwassielawyer explains with an example: if a token promises profits from a funded project, it is a security. Conversely, if it is purely speculative, like TRUMP, it is not. He states, “A memecoin without investment promises isn’t a security. It’s pure speculation, not linked to any project’s success.”

Regulatory Challenges for Value-Driven Crypto Projects

While memecoins have a clear legal status, the broader implications for the crypto sector are complex. Projects aimed at delivering real value face tougher regulatory scrutiny. Tokens with revenue potential or governance rights are more likely to be classified as securities. This has led to frustration within the industry, especially regarding enforcement by figures like SEC Chair Gary Gensler. Anonwassielawyer notes, “The discontent with Gensler arises not from enforcement but from labeling nearly everything as a security.”

Trump’s Dual Crypto Ventures: TRUMP vs. World Liberty Finance

The differing regulatory approaches to TRUMP and Trump’s other crypto venture, World Liberty Finance (WLFI), highlight a regulatory divide. While TRUMP is speculative, WLFI is designed to comply with U.S. securities laws. WLFI tokens are non-transferable for 12 months, aligning with Regulation D and Regulation S, which pertain to sales to U.S. accredited investors and non-U.S. persons.

Complexities of Offshore Structures in Crypto

Offshore structures, often seen as tools for regulatory evasion, actually serve legitimate functions, such as governance and tax optimization. Securities laws are territorial, meaning offshore setups, like those in the Cayman Islands, do not exempt projects from compliance if the tokens are marketed to U.S. individuals. However, they can offer tax benefits by deferring taxable events until assets are brought onshore.

Key Takeaways for the Crypto Industry

The lessons from Trump’s crypto endeavors are both enlightening and cautionary. Memecoins, despite their simplicity, avoid heavy regulatory oversight. Meanwhile, projects with real utility must navigate a complex regulatory landscape. Anonwassielawyer advises caution, stating, “Memecoins are intriguing, but transparency is crucial. Security-like features in tokens require adherence to established frameworks.”

At the time of writing, TRUMP is trading at $39.26.