Bitcoin as a Safeguard Against Sovereign Debt Crises

In light of mounting global debt and economic uncertainties, a fresh analysis by crypto asset manager Bitwise posits that Bitcoin (BTC) could serve as a formidable “portfolio insurance” against sovereign default threats. This assertion emerges as worldwide debt-to-GDP ratios soar to unprecedented heights, igniting fears of an impending global debt catastrophe.

Could Bitcoin Be the Answer to Looming Global Debt Defaults?

The report underscores Bitcoin as an appealing alternative for investors aiming to protect their assets in scenarios of sovereign defaults or rampant hyperinflation. It suggests that Bitcoin, in a theoretical construct, might function as “portfolio insurance” against a composite of major sovereign bonds, with its current “fair value” estimated at about $219,000 USD.

To understand this context, it’s crucial to note that international public debt is on an upward trajectory. Recently, the US public debt exceeded an alarming $36 trillion, accounting for 123% of the nation’s GDP. The rapid escalation of debt, especially since September 2024 with a surge of $917 billion, adds to these concerns.

This issue isn’t isolated to the US alone. Significant economies like France and the United Kingdom are also witnessing unprecedented hikes in public debt, causing jitters among bond investors globally. According to the Bitwise report, Bitcoin presents a compelling alternative to traditional safe-havens like gold. Its decentralized network architecture offers a ‘trustless system,’ differentiating it from sovereign bonds that depend on the issuer’s repayment capability.

Evaluating Sovereign Default Probabilities and Bitcoin’s Role

The report reveals that the weighted average probability of default for G20 nations over the next decade stands at 6.2%, with the US exhibiting a slightly lower probability of around 4.5%. It further notes that this model estimates Bitcoin’s “fair value” at approximately $219,000 per BTC. In a hypothetical scenario where all G20 sovereign bonds default simultaneously, Bitcoin’s theoretical “fair value” could skyrocket to roughly $3.5 million per Bitcoin.

Nonetheless, the analysis underlines that a short-term default by major economies remains improbable. Yet, the model provides a glimpse of Bitcoin’s potential price trajectory should such a situation arise.

Bitcoin’s Resilience Amid Global Economic Challenges

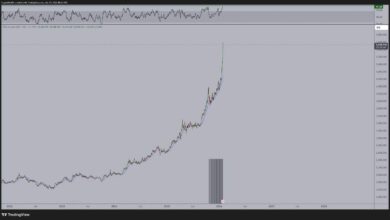

Since the dramatic downturn in March 2020 due to the coronavirus pandemic, Bitcoin has demonstrated remarkable stability, enduring significant macroeconomic challenges over the past five years. For instance, BTC maintained its resilience even as the US Federal Reserve announced plans to decelerate interest rate cuts in 2025.

In a similar vein, the reemergence of the Bitcoin ‘kimchi premium’ during South Korea’s political turmoil in December showcased investors’ inclination towards BTC as a safe haven in tumultuous times. Currently, Bitcoin is trading at $105,761, marking a 1.2% increase in the last 24 hours.

In conclusion, as global debt concerns heighten, Bitcoin’s role as a potential hedge against economic instability becomes increasingly significant. Its unique position as a decentralized asset offers investors an alternative path to safeguarding their wealth amid growing financial uncertainties.

“`