XRP’s Stellar Performance Amidst Market Volatility

During the final quarter of 2024, XRP has emerged as a standout performer, significantly elevating its market capitalization ranking amid a robust rally. In sharp contrast, numerous other cryptocurrencies have experienced substantial declines, triggered by a recent market downturn that wiped out billions in long positions, thus presenting a strategic buying opportunity for investors.

MultiversX (EGLD): Insights and Analysis

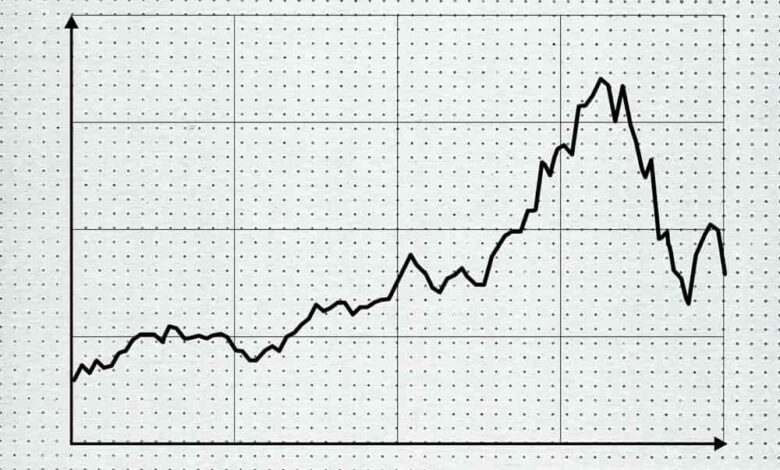

One cryptocurrency that has captured attention is MultiversX (EGLD), which has experienced a notable decline of over 42% from its local peak of $58.31, now priced at $33.63. Despite this downturn, technical analysis suggests that EGLD may present a promising buying opportunity, with potential for a rebound from its current support levels.

EGLD Price Analysis and Technical Indicators

Following a breakout on November 11, EGLD established a critical support zone after a prolonged period of consolidation. This momentum allowed EGLD to surpass the 200-day exponential moving average (1D 200-EMA), which is currently positioned around $34.91. Maintaining this price level above the support zone, especially after successfully withstanding last week’s crash, could enable another potential rally for MultiversX’s native token.

However, the daily Relative Strength Index (RSI) indicates weak momentum at 36.00, suggesting possible further bearish trends. Historically, such RSI levels have often been followed by short-term reversals and breakouts, as investors shift focus to the underlying fundamentals and capitalize on the buying opportunity.

Solid Fundamentals Underpinning MultiversX (EGLD)

Beyond the technical indicators, MultiversX’s “buy” potential is reinforced by its robust fundamentals, expert endorsements, and real-world traction through strategic partnerships and collaborations. Recognized as one of the most scalable, decentralized, and secure blockchain networks, MultiversX is well-equipped to meet high-demand scenarios. Justin Bons, the founder of Europe’s oldest cryptocurrency fund, has lauded MultiversX as the “technological Holy Grail of crypto” due to its advanced capabilities.

Notably, several analysts, including Lucky Luciano, EliZ, and Crypto Busy, have expressed keen interest in MultiversX, each boasting a substantial follower base on X. They anticipate significant growth, with Lucky Luciano targeting a $100 price point for EGLD, often referred to as “eGold,” emphasizing the substantial potential for future expansion.

Ongoing Development, Strategic Partnerships, and Global Collaborations

The MultiversX ecosystem is renowned for its commitment to active development, highlighted by global hackathons and collaborative events. In 2024, the Foundation organized the MultiversX Rust Bootcamp in Turkey, while Helios Stacking hosted a collaborative event with Injective (INJ) in Spain. Furthermore, Rather Labs recently held a MultiversX development-focused event in Argentina.

Looking ahead to 2025, MultiversX has partnered with Alibaba Cloud to host hackathons and related events across Asia. The Foundation has also launched a $1.5 million grants initiative known as Growth Games, aimed at supporting innovative blockchain and AI projects. Additionally, discussions are underway for a potential collaboration with Cardano’s (ADA) Charles Hoskinson.

Despite the promising fundamentals, potential investors should approach the decision to buy EGLD with caution, as it carries inherent risks typical of any investment, particularly in the volatile cryptocurrency market. Compared to more established blockchains like XRP, Ethereum (ETH), and Bitcoin (BTC), MultiversX remains relatively small in terms of market capitalization.

“`