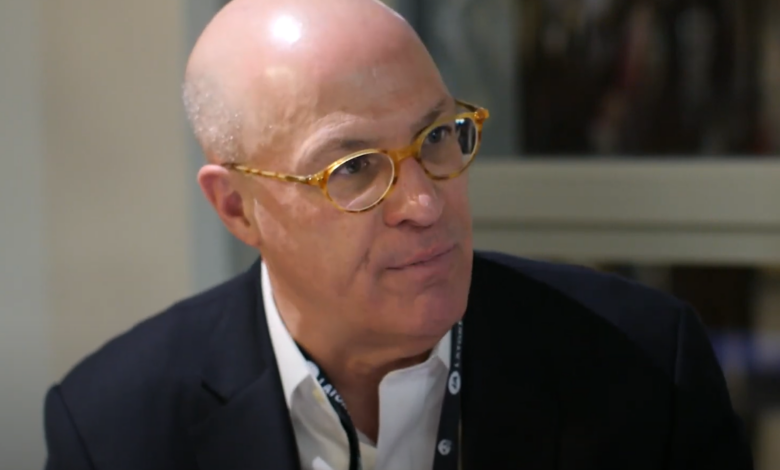

Chris Giancarlo Speaks on the Future of Cryptocurrency Regulation

In a comprehensive discussion with FOX Business, Chris Giancarlo, the former Chairman of the Commodity Futures Trading Commission (CFTC) and a prominent figure in the cryptocurrency space, shared his insights on the potential trajectory of US crypto regulations. With a possible role as the “crypto czar” in a future Trump administration, Giancarlo expressed optimism that the Securities and Exchange Commission (SEC) might eventually discontinue its case against Ripple Labs.

Envisioning US Leadership in Cryptocurrency and Blockchain

Known in digital asset circles as “Crypto Dad” due to his progressive stance, Giancarlo delved into the implications of former President Donald Trump potentially returning to office. He emphasized the importance of a unified approach to position the United States at the forefront of the cryptocurrency and blockchain revolution.

SEC May Withdraw From Ripple and Other Legal Challenges

The dialogue revealed a shift in Trump’s perspective on emerging technologies, including cryptocurrencies. Giancarlo reflected on Trump’s past focus on economic growth, recalling his straightforward inquiries to agencies about their contributions to achieving 4% economic growth. According to Giancarlo, Trump now perceives technologies like crypto, artificial intelligence, and quantum computing as catalysts that could significantly enhance the US economy. “Trump envisions a second industrial revolution in America, with crypto playing a crucial role,” Giancarlo stated.

The Ripple Case: A Legal Perspective

Addressing the contentious legal proceedings between the SEC and Ripple Labs, Giancarlo shared his stance that XRP should not be classified as a security under US regulations. His opinion aligns partly with Judge Torres’s 2023 ruling, which concluded that some XRP transactions were not securities. “Before the case, I published a detailed law review article arguing that XRP was not subject to SEC jurisdiction. The judge largely concurred with this view,” Giancarlo noted.

Looking towards the future, Giancarlo suggested that the SEC should reconsider its current legal battles, especially those where it has faced setbacks. “I believe it’s time for regulatory bodies to abandon cases where they’ve been unsuccessful in trial courts,” he recommended. When questioned on the likelihood of the SEC dropping its appeal against Ripple Labs, Giancarlo confidently stated, “I’m convinced they should and will. I would wager on it.”

Critique of the SEC and Leadership Transition

Giancarlo didn’t shy away from criticizing outgoing SEC Chairman Gary Gensler, pointing out challenges such as staff departures, low morale, and perceived excessive enforcement actions. He highlighted an incident where the SEC was “reprimanded by a federal court for deceiving the court,” which he believes damages the agency’s credibility. “The situation might be even more dire than what I observed at the CFTC,” he added, referring to the difficulties facing the SEC.

On the topic of new leadership at the SEC, Giancarlo expressed optimism for a chairperson with both institutional familiarity and a strong commitment to innovation and the crypto agenda. He proposed potential candidates like Paul Atkins, his former law school peer, and Kevin Hassett.

Strategizing for a Unified Crypto Policy Under Trump

Giancarlo underscored the necessity of a coordinated effort to realize Trump’s vision for a robust crypto policy. He advocated for forming a “crypto council” to foster collaboration among different government entities, including tax authorities and the White House Counsel’s Office. “A well-thought-out strategy is essential to fulfill President Trump’s crypto promises,” he concluded.

At the time of writing, XRP was trading at $1.45.