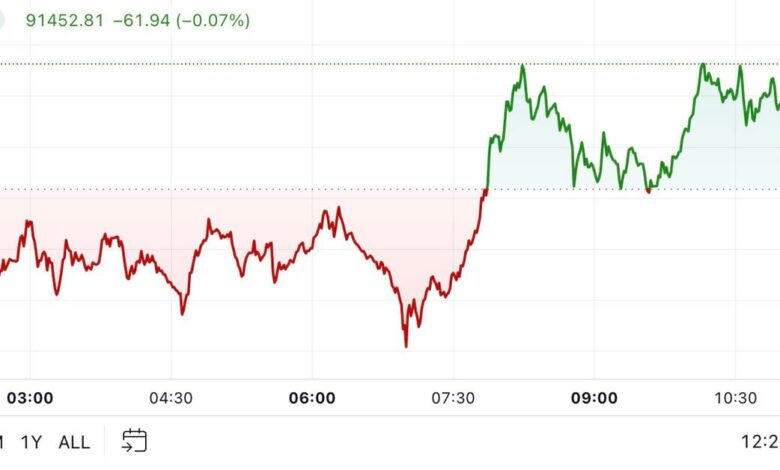

Bitcoin has been trading on either side of $91,000 after recovering from a dip to just above $89,000. The leading cryptocurrency is currently 2% lower than its all-time high of $93,445, which it reached during the U.S. afternoon on Wednesday. However, despite this dip, Bitcoin remains over 4% higher in the last 24 hours.

Bitcoin ETFs have been seeing significant inflows, with another $510 million recorded on Wednesday alone. This brings the total inflows for the last six days to $4.7 billion. According to analyst Checkmate, “The Bitcoin ETFs are by far the majority driving force of bitcoin demand right now, soaking up almost all of the selling by Long-Term Holders. CME open interest is not growing meaningfully, reinforcing that this is a spot-driven rally.”

This recent price action and the influx of institutional money into Bitcoin suggest a positive outlook for the cryptocurrency in the near term. While the market may experience some volatility in the coming days, the overall trend seems to be bullish, with investors showing increased interest in Bitcoin as an asset class.